Tag Archives: riverside bankruptcy lawyer

Is Your Income Too High For Bankruptcy?

Today, the economy seems to have recovered from the past recession. In your personal situation, you may be back to your normal income and employment may have already stabilized, but if you still have left-over debt that needs to be resolved as a result of an income interruption, bankruptcy can still be an option for Continue Reading

Got an Expensive Car or Bike You No Longer Want to Pay For?

Do you have a car or motorcycle that you bought a while back that you are not too excited about anymore? Are you behind on the huge payments and don’t know what to do? Bankruptcy can relieve you of the vehicle without any liability to follow. Here’s how it works. If you file a Chapter Continue Reading

Paralegal Doc Prep vs. Attorney Bankruptcy

When shopping for a bankruptcy service, you may come across paralegal services who advertise $200 document preparation services. You need to know what the difference between an attorney represented service and a paralegal document preparation service is. First of all, document preparation services do not need to be done by certified paralegals only. Sometimes, it Continue Reading

How Much Should You Pay an Attorney to File Bankruptcy?

The purpose of this article is to get everyone on the same page for bankruptcy pricing. We aim to provide the facts on how attorneys are pricing their services and what you really need to know about what you are paying for when you pay a law office or paralegal for bankruptcy services. For now, Continue Reading

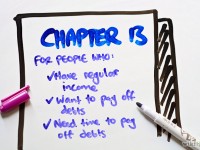

Chapter 13 and Recent Tax Debt

We have discussed the utilization of bankruptcy to manage tax debt in past articles. It is widely known that a bankruptcy cannot provide a discharge for tax debt more recent than 3 years old. For recent tax debt, Chapter 13 may be the only solution. A Chapter 13 bankruptcy can place your tax debt with Continue Reading

Is Bankruptcy Really “Bad” For Your Credit?

In a difficult financial situation where you are behind on debt payments without an end in sight, is filing a bankruptcy still “bad” for your credit profile? Bankruptcy on its own is definitely a negative impact on your credit profile, but the reality is that most people who are looking into bankruptcy may already be Continue Reading

Is Student Loan Debt Really Not Eligible for Discharge in Bankruptcy?

Student loan debt is a weight on the shoulders of many Americans. Our client base in Southern California regularly asks us whether or not we are able to help with student loan debt in bankruptcy. There are mixed messages out there on various websites, and most people are under the impression that student loan debt Continue Reading

Bankruptcy Attorneys in Riverside Court and San Bernardino Court

Bankruptcy Law Professionals has been practicing law in the Inland Empire for over a decade. We understand there are many choices to make when trying to select a bankruptcy attorney in the city of Riverside and surrounding areas, Riverside County, and San Bernardino County. Since the San Bernardino court system and the Riverside court system Continue Reading

Is your home still underwater due to a HELOC?

Bankruptcy is a HELOC Solution Did you know you can file a lien avoidance motion (lien strip motion) in a bankruptcy to remove a Home Equity Line of Credit or HELOC (Also known as 2nd mortgage, 2nd home loan, line of credit, junior lien, junior loan)? If your house is underwater due to a HELOC, Continue Reading

What Happens After Bankruptcy?

The most common concern when filing bankruptcy is facing the consequences of filing. Many are concerned about the credit impact in the future. A bankruptcy is recorded on your credit report and will remain on your credit report for 10 years unless you are able to manipulate the credit bureaus to remove the bankruptcy. In Continue Reading