Tag Archives: bankruptcy santa ana

Bankruptcy Credit Counseling Is Not Anything to Worry About

One of the major changes that spurred a large influx of bankruptcy filings was the changes made to require each bankruptcy filer to complete credit counseling sessions with the a certified/licensed bankruptcy credit counseling organization. There are many potential filers who are very concerned about the bankruptcy credit counseling. The purpose of this article is Continue Reading

Bankruptcy Is a Realistic Option

For many average consumers out there, bankruptcy is one thing that your parents and your colleagues tell you to avoid though out your life. When it comes to debt, all solutions should be considered if you are trying to resolve your debt when you are unable to make payments to pay it off. So, is Continue Reading

Can You File Bankruptcy If You Are Receiving a Tax Refund?

If you are worried about losing your tax refund because of a bankruptcy, don’t worry about it. It is not necessary to surrender your tax refund even if you are filing for bankruptcy. Your tax refund may stay in tact as long as you do not exceed the exemption limit for cash in a bank Continue Reading

What Happens If the Court Dismisses Your Bankruptcy?

There are several ways a bankruptcy case that was filed in court can be dismissed. The court may choose to dismiss a bankruptcy case if requested documents are not filed or if the filer does not qualify for a bankruptcy. A dismissal is not the end of your chances of getting a bankruptcy completed through Continue Reading

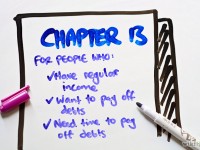

Chapter 13 and Recent Tax Debt

We have discussed the utilization of bankruptcy to manage tax debt in past articles. It is widely known that a bankruptcy cannot provide a discharge for tax debt more recent than 3 years old. For recent tax debt, Chapter 13 may be the only solution. A Chapter 13 bankruptcy can place your tax debt with Continue Reading

Do You Need To File 2013 Taxes Before Filing for Chapter 7?

A quick reminder that you should not need to wait until your taxes are filed to file a Chapter 7 or any other type of bankruptcy. Bankruptcy is based on your history of income and expenses. The bankruptcy court will not dismiss your file or disqualify you from bankruptcy if you have not filed your Continue Reading

Orange County Bankruptcy Attorney

Have you searched for the best Orange County Bankruptcy Attorney? Were you able to find what you were looking for? Were you unimpressed with what the internet led you to in the past? Orange County has a countless number of legal professionals providing bankruptcy services. There are many things to consider before electing an attorney Continue Reading

Is your home still underwater due to a HELOC?

Bankruptcy is a HELOC Solution Did you know you can file a lien avoidance motion (lien strip motion) in a bankruptcy to remove a Home Equity Line of Credit or HELOC (Also known as 2nd mortgage, 2nd home loan, line of credit, junior lien, junior loan)? If your house is underwater due to a HELOC, Continue Reading

How to Pay for Bankruptcy Services on a Low Budget

Filing for bankruptcy can sometimes be an additional financial problem on top of the debts that you already need to include in a bankruptcy. With many law firms charging upwards of $2000 or more for bankruptcy services, it may be difficult for some people to come up with the funds to file for bankruptcy if Continue Reading

Bankruptcy in Orange County: 2012 in Review

Bankruptcy Law Professionals has great wins from 2012 to report to all clients and potential clients. We would like to take this opportunity to provide a bankruptcy services review of 2012. 2012 allowed us to learn much more about the needs of the people in Orange County, California. Real estate issues were extremely important for Continue Reading