Tag Archives: bankruptcy orange county

What Happens While Your Bankruptcy Is “In Process”?

A bankruptcy attorney is always asked how long a bankruptcy will take to reach discharge and when the bankruptcy file will be closed. A Chapter 7 bankruptcy can take anywhere from a few months to several months depending on your situation, how your case is managed, and how fast the court system your are working Continue Reading

Does Bankruptcy Mean Death to Your Credit? The Answer is NO!

We have a general public perception of bankruptcy as a negative impact on your life and although it is true that a bankruptcy is not a favorable mark on your credit, bankruptcy should actually be perceived as a solution rather than the problem. Bankruptcy exists to help difficult financial situations. Your debt, collections, wage garnishments, Continue Reading

A Charge Off Is a Bad Thing For Your Credit

If you are late on paying a debt payment for over 90 days, you may see a label on your debt as “charged off”. This type of “charge off” label on a debt is not a positive mark. Many people falsely believe that a charge off means the debt has been charged off of your Continue Reading

5,607 Bankruptcy Filings Last Month in Orange County and Riverside

The Central District of California includes San Luis Obispo County, Santa Barbara County, Ventura County, Los Angeles, Orange County, San Bernardino County, and Riverside County. Within the Central District Jurisdiction, there were 5,607 total bankruptcy filings last month, March 2014. Out of all the California Districts (Northern, Southern, Eastern, Central), the Central District of California Continue Reading

Can You File Bankruptcy If You Are Receiving a Tax Refund?

If you are worried about losing your tax refund because of a bankruptcy, don’t worry about it. It is not necessary to surrender your tax refund even if you are filing for bankruptcy. Your tax refund may stay in tact as long as you do not exceed the exemption limit for cash in a bank Continue Reading

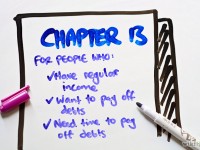

Chapter 13 and Recent Tax Debt

We have discussed the utilization of bankruptcy to manage tax debt in past articles. It is widely known that a bankruptcy cannot provide a discharge for tax debt more recent than 3 years old. For recent tax debt, Chapter 13 may be the only solution. A Chapter 13 bankruptcy can place your tax debt with Continue Reading

Is Bankruptcy Really “Bad” For Your Credit?

In a difficult financial situation where you are behind on debt payments without an end in sight, is filing a bankruptcy still “bad” for your credit profile? Bankruptcy on its own is definitely a negative impact on your credit profile, but the reality is that most people who are looking into bankruptcy may already be Continue Reading

Have You Lost Track of Your Debt?

Many consumers have multiple credit card balances and checking accounts. Some have past due rent from previous landlords, auto-deficiency debt after a repossession, payday loans from multiple companies. There are many types of unsecured debts to deal with, not to mention different collections companies that have been engaged to collect on your debts through various Continue Reading

Jobs Report Misses Expectations

Today’s jobs report has the US adding 113,000 jobs in January of 2014. The reason it has been deemed “disappointing” is because expectations were at 189,000. Unemployment rate reduced from 6.7% to 6.6% according to Wall Street Journal Money Beat. All the market indexes have reacted calmly so far. Are our economy and markets in Continue Reading

Can You File Chapter 13 Bankruptcy with High Income and Assets?

Are you still under the impression that if you have income and assets, bankruptcy is not available as a debt solution to you? Well, think again. As you can see here in an article about Nicole Eggert’s bankruptcy filing http://radaronline.com/exclusives/2014/01/nicole-eggert-files-for-bankruptcy/, she has over 15k in income per month and has total assets of over $1 Continue Reading