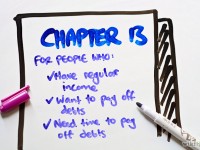

We have discussed the utilization of bankruptcy to manage tax debt in past articles. It is widely known that a bankruptcy cannot provide a discharge for tax debt more recent than 3 years old. For recent tax debt, Chapter 13 may be the only solution. A Chapter 13 bankruptcy can place your tax debt with the IRS in a payment plan, helping you avoid wage garnishments or bank account levies.

A Chapter 13 payment plan can be a maximum of 5 years and a minimum of 3 years. Qualifying for a Chapter 13 requires expendable income to provide evidence to the bankruptcy court that you will be able to handle a Chapter 13 payment plan. If you have tax debt owed to the IRS, you can file a Chapter 13 to place your tax debt into a payment plan where the tax debt is paid off in full for the minimum of 3 years or maximum of 5 years. We can use an example to illustrate.

Let’s say you have $30,000 of tax debt that is more recent than 3 years old. Since tax debt that was filed more recently than 3 years cannot be discharged in bankruptcy, more recent tax debt must be paid in full in a Chapter 13 plan. With $30,000 of tax debt, you must be able to afford to pay $500 per month to pay off a $30,000 IRS debt over 60 months (5 years). In this situation, your income less all of your expenses that you need to live must show that you have at least $500 per month left over to pay off the IRS debt over the 60 month period. By filing a Chapter 13, you will be able to stop collections activities that the IRS may engage against your wages or bank accounts. Chapter 13 bankruptcy protection will stop these activities as soon as the creditors are notified of the bankruptcy filing.

Qualifying for a Chapter 13 may be the the most complicated part of the process. You must be able to prove, in your petition paperwork, that your income minus expenses, will allow you to afford the minimum monthly payment for the maximum of 60 months or 5 years. You must show a stable enough income history to prove that you can make the payments. You should be able to use a free consultation at your local bankruptcy attorney’s office to make sure you qualify for Chapter 13 and to explain to you how the full process is going to pan out. There are many more details to learn about a Chapter 13 that will be very specific to your own situation.

Bankruptcy Law Professionals is a law firm based in Southern California with offices in Santa Ana and Riverside. We offer free consultations by phone or in-person. Please contact us at 855 257-7671 to set up your consultation.