Tag Archives: bankruptcy anaheim

Bankruptcy Credit Counseling Is Not Anything to Worry About

One of the major changes that spurred a large influx of bankruptcy filings was the changes made to require each bankruptcy filer to complete credit counseling sessions with the a certified/licensed bankruptcy credit counseling organization. There are many potential filers who are very concerned about the bankruptcy credit counseling. The purpose of this article is Continue Reading

A Charge Off Is a Bad Thing For Your Credit

If you are late on paying a debt payment for over 90 days, you may see a label on your debt as “charged off”. This type of “charge off” label on a debt is not a positive mark. Many people falsely believe that a charge off means the debt has been charged off of your Continue Reading

Bankruptcy Is a Realistic Option

For many average consumers out there, bankruptcy is one thing that your parents and your colleagues tell you to avoid though out your life. When it comes to debt, all solutions should be considered if you are trying to resolve your debt when you are unable to make payments to pay it off. So, is Continue Reading

Will Bankruptcy Discharge Your Mortgage?

Clients call in about many different types of debt, but one type of debt that is usually the most important to our clients is their mortgage debt. Mortgage debt is usually the largest debt amount for most home owners. Filing for bankruptcy does not always mean that you will lose your home and wipe out Continue Reading

Is It Ok to Ignore Your Collection Calls?

If you have past due debt, you may be getting collection calls from the company you owe the debt to or from a collections agent that is working for the creditor. The creditor may also sell the debt to another collections company that has more time to focus on collecting a debt. You may be Continue Reading

What Happens If the Court Dismisses Your Bankruptcy?

There are several ways a bankruptcy case that was filed in court can be dismissed. The court may choose to dismiss a bankruptcy case if requested documents are not filed or if the filer does not qualify for a bankruptcy. A dismissal is not the end of your chances of getting a bankruptcy completed through Continue Reading

Bankruptcy for Your Small Business Non-Consumer Debt

Do you have overdue small business debt? Those of you with small businesses may be dealing with some debt as a result of the recession. The recession was tough on small business, but bankruptcy is a federal process that can also help you with your small business debt. Most small business loans are backed by Continue Reading

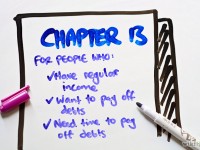

Chapter 13 and Recent Tax Debt

We have discussed the utilization of bankruptcy to manage tax debt in past articles. It is widely known that a bankruptcy cannot provide a discharge for tax debt more recent than 3 years old. For recent tax debt, Chapter 13 may be the only solution. A Chapter 13 bankruptcy can place your tax debt with Continue Reading

Do You Need To File 2013 Taxes Before Filing for Chapter 7?

A quick reminder that you should not need to wait until your taxes are filed to file a Chapter 7 or any other type of bankruptcy. Bankruptcy is based on your history of income and expenses. The bankruptcy court will not dismiss your file or disqualify you from bankruptcy if you have not filed your Continue Reading

Orange County Bankruptcy Attorney

Have you searched for the best Orange County Bankruptcy Attorney? Were you able to find what you were looking for? Were you unimpressed with what the internet led you to in the past? Orange County has a countless number of legal professionals providing bankruptcy services. There are many things to consider before electing an attorney Continue Reading