Tag Archives: bankruptcy riverside

Bankruptcy or Debt Settlement?

People who are on the fence about bankruptcy also tend to look at debt settlement as an alternate solution. There are definitely situations where a bankruptcy is less favorable than debt settlement, but you should learn the facts for both. Considering both solutions means that you should learn the process for both services including cost, Continue Reading

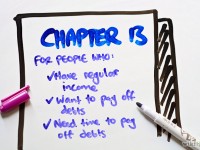

Chapter 13 and Recent Tax Debt

We have discussed the utilization of bankruptcy to manage tax debt in past articles. It is widely known that a bankruptcy cannot provide a discharge for tax debt more recent than 3 years old. For recent tax debt, Chapter 13 may be the only solution. A Chapter 13 bankruptcy can place your tax debt with Continue Reading

Do You Need To File 2013 Taxes Before Filing for Chapter 7?

A quick reminder that you should not need to wait until your taxes are filed to file a Chapter 7 or any other type of bankruptcy. Bankruptcy is based on your history of income and expenses. The bankruptcy court will not dismiss your file or disqualify you from bankruptcy if you have not filed your Continue Reading

Is Bankruptcy Really “Bad” For Your Credit?

In a difficult financial situation where you are behind on debt payments without an end in sight, is filing a bankruptcy still “bad” for your credit profile? Bankruptcy on its own is definitely a negative impact on your credit profile, but the reality is that most people who are looking into bankruptcy may already be Continue Reading

Have You Lost Track of Your Debt?

Many consumers have multiple credit card balances and checking accounts. Some have past due rent from previous landlords, auto-deficiency debt after a repossession, payday loans from multiple companies. There are many types of unsecured debts to deal with, not to mention different collections companies that have been engaged to collect on your debts through various Continue Reading

March is National Start A Business Month – Learn About Non-Consumer Debt Ch. 7

With National Start a Business Month on the way in March, keep up with your business acumen and learn how to eliminate your business debt in case things do not go as planned. Bankruptcy Code has some built-in flexibility for dealing with business debt. In this article, we will be taking a closer look at Continue Reading

Jobs Report Misses Expectations

Today’s jobs report has the US adding 113,000 jobs in January of 2014. The reason it has been deemed “disappointing” is because expectations were at 189,000. Unemployment rate reduced from 6.7% to 6.6% according to Wall Street Journal Money Beat. All the market indexes have reacted calmly so far. Are our economy and markets in Continue Reading

Can You File Chapter 13 Bankruptcy with High Income and Assets?

Are you still under the impression that if you have income and assets, bankruptcy is not available as a debt solution to you? Well, think again. As you can see here in an article about Nicole Eggert’s bankruptcy filing http://radaronline.com/exclusives/2014/01/nicole-eggert-files-for-bankruptcy/, she has over 15k in income per month and has total assets of over $1 Continue Reading

Tax Debt in Bankruptcy

The 2014 Tax season is upon us. We are here to help you if you are in need of assistance with tax debt. Many believe that tax debt, IRS debt, or Franchise Tax Board (state tax) debt is not eligible for bankruptcy relief. Bankruptcy Law Professionals is here to tell you that tax debt can Continue Reading

Can You Keep Your Car After A Bankruptcy?

In Southern California, our automobiles are considered to be an important part of our lives. Whether you live in sunny Orange County or Riverside County, our cars are our best friends. Cars provide transportation to work and can also play the role of an air conditioning station through the hot summer days. No one wants Continue Reading